For Immediate Release | October 22, 2025

Contact: David McMahon, J.D. (304) 993-0468, wvdavid@wvdavid.net

The Governor’s Plugging Assurance Deal with Diversified

Does Not Do What They Say.

No one is more affected by orphaned wells than surface owners whose land is devalued by and potentially polluted by unplugged wells. Neither surface owners nor environmental groups were consulted, and they were surprised by, the press release announcing of a new plugging assurance deal with the State’s largest well owner. Our initial response was based solely on questions the press release raised. WVSORO has finally been able after a FOIA to get one of the two or more actual documents related to the deal, and we now have this further response to the novel proposal.

Charleston, W.Va. — On October 16, 2025, the Governor and the owner of Diversified announced a new way to “ensure all Diversified [oil and gas] wells in the state are safely plugged and retired.” At the time of the deal announcement, the press release was all WVSORO had to go on to come up with a response. The Governor would not give out the actual plugging consent agreement that is part of the deal, and we can see why he did not initially talk to us before his announcement or hand out the consent agreement. It is arithmetically untrue that this new deal will plug “all” of Diversified’s wells. Part of the concept may not be bad, but the dollars in this deal do not work, and we do not see the need for a middle man insurance company that will surely also get some part of the money.

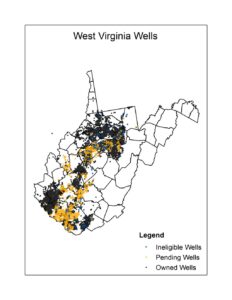

Now the State has finally responded after a FOIA request, and we have seen the actual consent agreement. [See attached.] The requirements in the new consent order cover 80 years. The deal requires that Diversified plug 75 wells a year for the first 20 years. (It replaces the well plugging numbers requirements of at least four previous consent orders we are still asking for.) The new order will plug only 4% a year of the 2,000 wells the company should already have plugged. And if the company gets all those done, at the end of the first 20 years they will only have plugged 8% of their 20,000 total West Virginia wells that will eventually need plugged. All of these wells will be declining sharply in production to zero.

A third party insurance “asset retirement agreement” is another part of the deal not handed out. And we are still looking into “OneNexus and its partner “global insurance company” named Munich RE to see if their solvency is regulated. This “third party agreement” is said to provide that if Diversified does not plug those 75 wells a year in the first 20-year term, or does not plug the 225 wells per year in the next 60 years, then OneNexus is supposed to reimburse the State for plugging them. But the reimbursement rate of the deal is only a maximum of $32,000 per well. Although there are some extra costs for the plugging companies getting $90,000 per well from the federal government plugging money, we think all the costs of well plugging are much more than $32,000 a well. And this new deal’s $32,000 maximum amount is not adjusted for inflation for the 80 years of the deal!

And even those meager plugging numbers rely on the assumption that the $70 million Diversified pays during the first 20 years of the plugging insurance deal is “expected to grow over time to $650 million.” That would mean earning more than 11% per year in interest! And what does OneNexus get paid out of the deal for providing this insurance investment? And we wonder whether $265 million would plug even half of Diversified’s wells? We know that in 2018 Diversified reported that its wells would “reach the end of their economic lives” in 2048, and the next year they would have 50,000 wells across all of Appalachia. [See attached.] Is this really a scheme for Diversified to remove the enormous plugging liability on its books and turn it instead into an annual insurance payment liability and income tax deduction — so it can convince investors to fund its purchase of more wells it will never be able to plug?

The idea of drillers putting away money now to plug wells when the time comes is a good one. The Legislature should require it. But the numbers in this deal do not add up. What really needs done, is for drillers to be required to start setting aside money in escrow in banks paying interest just as soon as each well first starts producing, when the wells are producing the most, in order to pay themselves later to plug the wells. And the same should happen for transferred wells. For decades, companies with enough money from drilling new wells to pay to plug their own old wells instead transferred the old wells to smaller companies who will not in the end be able to afford to plug them. Diversified’s original sin was to put that practice on steroids. Instead of paying to puprchase the thousands of wells they now own, they should have been paid to take the wells.

###END###