- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

This article originally provided by Dow Jones Newswire

LONDON (Dow Jones) — Chesapeake Energy on Tuesday announced the latest in a series of deals to raise funds and find partners to develop its natural-gas holdings, getting as much as $3.37 billion from Norway’s StatoilHydro.

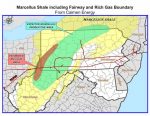

Terms call for StatoilHydro (STO), Europe’s second-largest natural-gas supplier, to buy a 32.5% interest in Chesapeake’s Marcellus shale-gas acreage in the Appalachia region.

Chesapeake (CHK), the top U.S. natural-gas producer, will receive $1.25 billion in cash and as much as $2.125 billion more depending on drilling activity.

Chesapeake shares fell more than 5% to $22.42 in midday trades. U.S.-traded shares of StatoilHydro dropped 7% to $18.02.

During 2008, Chesapeake shares have dropped close to 40%; StatoilHydro’s have dropped more than 20%.

The agreement will cover more than 32,000 leases in Pennsylvania, West Virginia, New York and Ohio. Chesapeake plans to continue acquiring leases in the Marcellus shale play. StatoilHydro has the right to a 32.5% participation in any such additional leasehold.

Statoil will get 2.5 billion to 3 billion barrels of oil equivalent under the deal.

The program could support the drilling of 13,500 to 17,000 horizontal wells over the next 20 years with a continuous program using as many as 50 drilling rigs.

The expected cost for each well is estimated at $3.5 million with an ultimate recovery of about 560,000 barrels of oil equivalent per well.

Analysts at SunTrust Robinson Humphrey said the price amounts to $5,600 per acre, above recent prices in the $2,000 to $3,000 an acre range.

Chesapeake has been actively selling assets to raise capital, raising $5.2 billion from deals with Plains Exploration & Production (PXP) and BP (BP).

Chesapeake came under heavy selling pressure in early October, hit by falling natural-gas prices, tight credit markets and an ambitious but costly capital spending program, but its stock price recovered somewhat on merger-and- acquisitions speculation.

(END) Dow Jones Newswires

11-11-08 1458ET

Copyright (c) 2008 Dow Jones & Company, Inc.